abt0.ru

Overview

How To Purchase Index Funds On Fidelity

How to invest your money · Pick an account · Funding the accounts · Choose your investments · Place a trade · Check in on your investments · Footer. Fidelity Index FXAIX · NAV / 1-Day Return / − % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution Fee. If you make regular contributions into a mutual fund, each additional investment could come with a purchase fee. Say one fund is available free of transaction. The Fidelity Index Fund tracks the S&P index, one of the main 7 Best Fidelity Mutual Funds to Buy. Here's how you can sift through. Fidelity Total Market Index Fund. $ FSKAX ; Fidelity Large Cap Growth Index Fund. $ FSPGX ; Vanguard Index Fund Admiral Shares. $ VFIAX. Fidelity exchange-traded funds (ETFs) available for online purchase commission-free. ETF types include active equity, thematic, sustainable, stock, sector. 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares, then enter an amount. In this comprehensive guide, we will walk you through the steps to buy index funds with Fidelity, from opening an account to placing your order. How to buy: The fund can be purchased directly from the fund company or through most online brokers. Vanguard S&P ETF (VOO). Overview: As its name suggests. How to invest your money · Pick an account · Funding the accounts · Choose your investments · Place a trade · Check in on your investments · Footer. Fidelity Index FXAIX · NAV / 1-Day Return / − % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution Fee. If you make regular contributions into a mutual fund, each additional investment could come with a purchase fee. Say one fund is available free of transaction. The Fidelity Index Fund tracks the S&P index, one of the main 7 Best Fidelity Mutual Funds to Buy. Here's how you can sift through. Fidelity Total Market Index Fund. $ FSKAX ; Fidelity Large Cap Growth Index Fund. $ FSPGX ; Vanguard Index Fund Admiral Shares. $ VFIAX. Fidelity exchange-traded funds (ETFs) available for online purchase commission-free. ETF types include active equity, thematic, sustainable, stock, sector. 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares, then enter an amount. In this comprehensive guide, we will walk you through the steps to buy index funds with Fidelity, from opening an account to placing your order. How to buy: The fund can be purchased directly from the fund company or through most online brokers. Vanguard S&P ETF (VOO). Overview: As its name suggests.

Take advantage of free guidance to search through Fidelity mutual funds. “Investors will not pay any expenses.” The funds—which the company says have already attracted $ billion—include Fidelity Zero Large Cap Index Fund. Free commission offer applies to online purchase of ETFs in a Fidelity retail account. The sale of ETFs is subject to an activity assessment fee (from $ to. Schwab's short-term redemption fee of $ will be charged on redemption of funds purchased through Schwab's Mutual Fund OneSource® service (and certain other. We also offer zero minimum investment Fidelity Mutual Funds, no minimums to open an account, 3 no account fees for retail brokerage accounts, and 24/7 live. 1) Prerequisite alert! · 2) Login to your Fidelity account and go to abt0.ru · 3) Click the “Set up. 4 Best Mutual Funds to Buy for a Stress-Free Retirement. Jun. 17, at p.m. ET on abt0.ru 7 Fidelity Index Funds That Belong on Your. Analyze the Fund Fidelity ® Index Fund having Symbol FXAIX for type mutual-funds and perform research on other mutual funds. Learn more about mutual. How To Invest in Index Funds. Investing in index funds is straightforward for Index Fund (VTSAX) or the Fidelity Index Fund (FXAIX). For. Fidelity Index Fund FXAIX has $ BILLION invested in fossil fuels, % of the fund. Click "Buy a mutual fund," then click Continue. Enter a valid mutual fund symbol and a dollar amount. Note that the total dollar amount for the trade may be. Unlike stocks and ETFs, mutual funds trade only once per day, after the markets close at 4 p.m. ET. If you enter a trade to buy or sell shares of a mutual fund. Neither mutual funds nor ETFs are perfect. Both can offer comprehensive exposure at minimal costs, and can be good tools for investors. “Investors will not pay any expenses.” The funds—which the company says have already attracted $ billion—include Fidelity Zero Large Cap Index Fund. The following nine investments all are standouts that might work for you if you're looking for the best Fidelity mutual funds right now. 1. Fidelity Index Fund (FXAIX) · 2. Fidelity NASDAQ Composite Index Fund (FNCMX) · 3. Fidelity ZERO International Index Fund (FZILX) · 4. Fidelity Mid Cap. You choose the Vanguard funds through your account on-line through the TIAA or Fidelity secure websites or by calling their national call centers to make. Points to know · You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. · You must have a. It's not an actual investment but rather information that is gathered and tracked. However, you can invest in an index fund. An index fund is a type of mutual. Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Fidelity Small Cap Index Fund (FSSNX) · Fidelity International Index Fund (FSPSX).

Reduce Home Loan Interest Rate

For example, on a $, loan, one point would cost you $2, at closing. One mortgage point generally results in an interest rate reduction of% to.5%. Benefits of Home Loan interest rate · Loans from ₹3 lakh to ₹5 crore for diverse property investments. · Flexible EMIs for comfortable financial planning. · Choice. RE/MAX: Rates will drop to % at the end of the 1st Quarter of “Economists predict that mortgage rates will remain elevated for most of and that. Another reason for lenders not reducing their base rate is that such action affects a major chunk of their loan portfolio and, thus, their balance sheet (read. To put it simply, it's the mortgage rate that saves you the most money once you factor in fees, closing costs, and loan terms. Tips to Reduce Home Loan Interest Rate · 1. Go for a Shorter Tenure · 2. Prepayments Are a Good Option Too · 3. Compare Interest Rates Online. 6 Proven Strategies That Reduce Home Loan Interest Rate · 1. Improve your Credit score · 2. Choose the right loan tenure · 3. Opt for a Floating Interest Rate. To put it simply, it's the mortgage rate that saves you the most money once you factor in fees, closing costs, and loan terms. A mortgage buydown allows you to pay extra money upfront to secure a lower interest rate on your home loan. A reduced rate can save you thousands of dollars. For example, on a $, loan, one point would cost you $2, at closing. One mortgage point generally results in an interest rate reduction of% to.5%. Benefits of Home Loan interest rate · Loans from ₹3 lakh to ₹5 crore for diverse property investments. · Flexible EMIs for comfortable financial planning. · Choice. RE/MAX: Rates will drop to % at the end of the 1st Quarter of “Economists predict that mortgage rates will remain elevated for most of and that. Another reason for lenders not reducing their base rate is that such action affects a major chunk of their loan portfolio and, thus, their balance sheet (read. To put it simply, it's the mortgage rate that saves you the most money once you factor in fees, closing costs, and loan terms. Tips to Reduce Home Loan Interest Rate · 1. Go for a Shorter Tenure · 2. Prepayments Are a Good Option Too · 3. Compare Interest Rates Online. 6 Proven Strategies That Reduce Home Loan Interest Rate · 1. Improve your Credit score · 2. Choose the right loan tenure · 3. Opt for a Floating Interest Rate. To put it simply, it's the mortgage rate that saves you the most money once you factor in fees, closing costs, and loan terms. A mortgage buydown allows you to pay extra money upfront to secure a lower interest rate on your home loan. A reduced rate can save you thousands of dollars.

It is important to reduce the cost of your Home Loan by reducing the interest rate. A shorter loan tenure results in faster loan repayment, thus lowering the. Preferred Rewards members may qualify for an origination fee or interest rate reduction based on your eligible tier at the time of application. Depending on. Existing home loan borrowers can reduce their interest burden by transferring their outstanding loan amount to a new lender that offers them a lower interest. Yes, to some degree, mortgage interest rates are negotiable. Mortgage lenders have some flexibility when it comes to the rates they offer. A rate-improvement mortgage permits a borrower a one-time option to reduce their home loan interest rate when interest rates have dropped below the original. Many would-be homebuyers are feeling the pinch from rising interest rates, but you don't have to! APM has buydown options to help you reduce your mortgage. You can significantly reduce the overall interest charged on your mortgage by making extra or lump sum payments towards your principal amount. The additional. % reduction) or less than 6 months % reduction). Additional Adjustable Rate Mortgage Details. Margin is %. Cap is 2% Maximum Adjustment per Year — 6. Today's year mortgage rates are currently % lower than they were last fall, when rates hit %. For a $, home loan, a % lower rate saves you. The Home Loan interest rate can be reduced by doing a Balance Transfer to the new lender offering a lower rate of interest as compared to the existing lender. Mortgage rates dipped again this week, with the year fixed rate inching down to percent, according to Bankrate's latest lender survey. Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1%. Select a shorter loan duration: Shorter duration loans reduce the total cash outflow, including the interest component. Consider variable interest rates: These. How can I reduce the interest on my mortgage? · Know how much you owe · Be aware of the specifics of your mortgage · Change how often you're making payments · Make. Reduce Home Loans - the most awarded non-bank lender for having the cheapest home loan in Australia. Call us on Maintain a good credit score, choose the right loan tenure, go for a Floating Interest Rate, negotiate with your lender, make a larger down payment and. mortgage loan from Navy Federal Credit Union. ↵. 6. Exercising the no-refi rate-drop option will permanently reduce your interest rate, as well as the. If today's interest rates are lower than what you are currently paying every month, it's worth exploring your options with one of our PHH Mortgage loan. Check current mortgage rates to purchase a home or refinance your loan. Schwab offers secured loans that you can use for mortgages with affordable interest. The Home Equity Line of Credit has a variable rate that may increase or decrease Rate Loan Option, resulting in fixed monthly payments at a fixed interest.

Define Short Squeeze

Short squeezes occur when a highly shorted stock suddenly and quickly increases in price. A stock is shorted when short sellers bet on the stock going down. A. A short squeeze is caused by a large number of traders shorting an asset or market at the same abt0.ru short against a market or asset may be. A phenomenon in financial markets where a sharp rise in the price of an asset forces traders who previously sold short to close out their positions. A short squeeze is a situation in the stock market when there is a rapid increase in the price of a particular public company's shares. A phenomenon in financial markets where a sharp rise in the price of an asset forces traders who previously sold short to close out their positions. A short squeeze occurs when many investors go short on a stock (bet against it), but the stock's price instead shoots up. A short squeeze happens when many investors short a stock (bet against it) but the stock's price shoots up instead. The phenomena has the potential to make. A rise in borrowing costs and the amount of shares on loan may signal a potential short squeeze. If borrowing becomes more expensive and fewer shares are. A short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying fundamentals. Short squeezes occur when a highly shorted stock suddenly and quickly increases in price. A stock is shorted when short sellers bet on the stock going down. A. A short squeeze is caused by a large number of traders shorting an asset or market at the same abt0.ru short against a market or asset may be. A phenomenon in financial markets where a sharp rise in the price of an asset forces traders who previously sold short to close out their positions. A short squeeze is a situation in the stock market when there is a rapid increase in the price of a particular public company's shares. A phenomenon in financial markets where a sharp rise in the price of an asset forces traders who previously sold short to close out their positions. A short squeeze occurs when many investors go short on a stock (bet against it), but the stock's price instead shoots up. A short squeeze happens when many investors short a stock (bet against it) but the stock's price shoots up instead. The phenomena has the potential to make. A rise in borrowing costs and the amount of shares on loan may signal a potential short squeeze. If borrowing becomes more expensive and fewer shares are. A short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying fundamentals.

A short squeeze triggers fast-rising prices across a stock's value, or that of another tradable security. Short squeezes occur when a single security has a high. A short squeeze is a market phenomenon that occurs when a heavily shorted stock experiences a rapid and significant increase in price. It often happens when. A short squeeze occurs when the price of a stock moves sharply higher, prompting traders who bet its price would fall to buy it to avoid greater losses. Key Points. A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze. A short squeeze is a doom loop that occurs when too many people short a stock, but the stock price increases. As the stock price increases. A short squeeze is a doom loop that occurs when too many people short a stock, but the stock price increases. As the stock price increases. Short squeezes are market events where traders push up the value of a stock, forcing short sellers to buy (go long) to minimise their losses. If they choose to — or are forced to — close their position, they are buying the stock to close. This can push the price higher and force other short sellers to. Short Squeeze. A short squeeze happens when there is excess demand and a lack of supply for a particular financial security. What happens is that due to the. A short squeeze is one of the rarest stock market conditions that result in an unprecedented rally in the prices of a stock or any other tradable security. This. A short squeeze refers to a rapid increase in the price of a stock or other tradable security, primarily due to an excess of short selling. A short squeeze happens when market prices rise beyond the predictions of market analysts, 'squeezing' traders out of the market. Short squeeze in trading. A short squeeze happens when market prices rise beyond the predictions of market analysts, 'squeezing' traders out of the market. In. This is a case of an organised short abt0.rus of the forums investing in the stock didn't intend to create a short squeeze, but the outcome was the same. What Is A Short Squeeze? Bulls take long positions seeking to profit from buying low and selling higher. Bears take short positions seeking to profit from. They can face theoretically unlimited losses when shares rise. Their pain, however, can be a short squeezer's gain. Understanding Short Squeezes. Short sellers are investors who borrow stocks and then sell them in hopes of buying them back at a lower price in the future. When there is a sudden rise in. A short squeeze happens when big gains in a stock price force short-sellers to cover their shorts by buying back the stock, which then adds to. What is a Short Squeeze? A short squeeze occurs when the price of a stock rises sharply, forcing short sellers to buy shares to exit their positions. In. When short sellers targeted Piggly Wiggly stock in , its founder, Clarence Saunders, was determined to get back at those who bet against his company.

How To Compute Federal Tax

Especially when you factor in recent tax law changes. Use our income tax calculator to help forecast your federal income taxes before you file. Just enter your. Since your tax bracket is based on taxable income, it's important to have an estimate of your income. Start with your last filing. You can then adjust your. You can easily figure out your effective tax rate by dividing the total tax by your taxable income from Form For corporations, the effective tax rate is. Below is the table of tax rates at the time of this writing. Current rates may be obtained from the IRS. Taxable income. (TI) in $. Federal Tax. Rate . Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. This calculator will help you determine how much is being withheld as a percentage and monthly dollar amount. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. Especially when you factor in recent tax law changes. Use our income tax calculator to help forecast your federal income taxes before you file. Just enter your. Since your tax bracket is based on taxable income, it's important to have an estimate of your income. Start with your last filing. You can then adjust your. You can easily figure out your effective tax rate by dividing the total tax by your taxable income from Form For corporations, the effective tax rate is. Below is the table of tax rates at the time of this writing. Current rates may be obtained from the IRS. Taxable income. (TI) in $. Federal Tax. Rate . Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. This calculator will help you determine how much is being withheld as a percentage and monthly dollar amount. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year.

85% of your Social Security income can be taxed. Learn what is taxable, how benefit taxes are calculated & create a strategy to lower your taxable. You'll need to know your filing status, add up all of your sources of income and then subtract any deductions to find your taxable income amount. Use these online calculators to calculate your quarterly estimated income taxes, the interest amount Federal Tax. -$ State Tax. -$ FICA. -$ Federal Income Tax Withholding Calculator ; Enter your gross taxable monthly pension amount: $ ; Enter the total of other deductions (for example, health. Use our Tax Bracket Calculator to understand what tax bracket you're in for your federal income taxes. Based on your annual taxable income and. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. Use this IRS calculator tool for the year ahead to determine how to complete Form W-4 so you don't have too much or too little federal income tax withheld. Free online income tax calculator to estimate U.S federal tax refund or owed amount for both salary earners and independent contractors. Estimate your tax refund or how much you may owe the IRS with TaxCaster tax calculator. Feel confident with our free tax calculator that's up to date on the. The income tax calculator helps to determine the amount of income tax due or owed to the IRS. You can also estimate your tax refund if applicable. Calculate your federal taxes with H&R Block's free income tax calculator tool. Answer a few, quick questions to estimate your tax refund. Use this calculator to help estimate your federal marginal tax rate, average income tax rate, and tax bracket for the tax year shown below. Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. The top marginal federal income tax rate has varied widely over time (figure 2). The top rate was 91 percent in the early s before the Kennedy/Johnson tax. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1, Your total tax is located on Form , line 24 of your federal tax return. Your taxable income is your gross income minus the standard deduction or your. Personal Income Tax Calculator. No Internet Loading. Filing Status: Single, Married filing jointly, Married filing separately, Head of household. 85% of your Social Security income can be taxed. Learn what is taxable, how benefit taxes are calculated & create a strategy to lower your taxable. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. Why? As this.

Spy Stock Rating

An easy way to get SPDR S&P ETF TRUST real-time prices. View live SPY stock fund chart, financials, and market news. SPY - SPDR S&P ETF Trust - Stock screener for investors and traders, financial visualizations. Costs Excellent · Tracking Error Excellent · Bid/Ask Ratio Typical · Holdings Diversity Good. The Barchart Technical Opinion rating is a 88% Buy with a Strengthening short term outlook on maintaining the current direction. Long term indicators fully. SPDR S&P ETF Trust - USD (abt0.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for ETF SPDR S&P ETF Trust - USD. The Trust consists of a portfolio representing all stocks in the S&P Index. It holds predominantly large-cap US stocks. Holdings · Charts · Historical Quotes · Options · Premium Tools. SPY Overview. Key Data. Open $; Day Range - ; 52 Week Range - Stock Exposure Tool · ETF Issuer Fund Flows · Research · ETF Holdings Analysis. The following charts reflect the allocation of SPY's underlying holdings. Find the latest SPDR S&P ETF Trust (SPY) stock quote, history, news and other vital information to help you with your stock trading and investing. An easy way to get SPDR S&P ETF TRUST real-time prices. View live SPY stock fund chart, financials, and market news. SPY - SPDR S&P ETF Trust - Stock screener for investors and traders, financial visualizations. Costs Excellent · Tracking Error Excellent · Bid/Ask Ratio Typical · Holdings Diversity Good. The Barchart Technical Opinion rating is a 88% Buy with a Strengthening short term outlook on maintaining the current direction. Long term indicators fully. SPDR S&P ETF Trust - USD (abt0.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for ETF SPDR S&P ETF Trust - USD. The Trust consists of a portfolio representing all stocks in the S&P Index. It holds predominantly large-cap US stocks. Holdings · Charts · Historical Quotes · Options · Premium Tools. SPY Overview. Key Data. Open $; Day Range - ; 52 Week Range - Stock Exposure Tool · ETF Issuer Fund Flows · Research · ETF Holdings Analysis. The following charts reflect the allocation of SPY's underlying holdings. Find the latest SPDR S&P ETF Trust (SPY) stock quote, history, news and other vital information to help you with your stock trading and investing.

The Score for SPY is 59, which is 18% above its historic median score of 50, and infers lower risk than normal. SPY is currently trading in the %. The S&P's stellar performance, driven by large-cap technology stocks in the mid-to-late s and after the Great Recession, helped the SPY to continue. Component Grades · A · C · Get Rating · C · SPY Price/Volume Stats - 7 Best ETFs for the NEXT Bull Market · SPY Stock Price Chart Interactive Chart > · SPDR S&P Technical Analysis of SPY The stock exhibits a strong bullish sentiment with a Moving Average Score of 96, indicating robust upward momentum, while. Consensus Ratings. Buy. 93 Hold. 7 Sell. Based on the consensus analyst ratings on stocks held in SPY. TipRanks enables you to focus on the analyst. Stockchase rating for SPDR S&P ETF is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock while. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the. % Rank in Category, 20, 23, 21, 20, Quintile Rank, 1, 2, 2, 1, 1. 3, 5, and 10 Year Returns are Annualized. Historical Prices. 07/31/ - 08/30/ Last. - Launched in January , SPY was the very first exchange traded fund listed in the United States. To request a copy of the Research House Ratings Reports. Track SPDR S&P ETF (SPY) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get. SPDR S&P ETF Trust (SPY) ; YTD Return · % · % ; 1-Year Return · % · % ; 3-Year Return · % · %. The fund invests in growth and value stocks of large-cap companies. It seeks to track the performance of the S&P Index, by using full replication technique. SPY, SPDR S&P ETF Trust - Stock quote performance, technical chart analysis, SmartSelect Ratings, Group Leaders and the latest company headlines. Total Returns ; Fund. ; Category. ; S&P ; Rank in Category. 20%. 23% ; Quintile Rank. 1. 2. The SPY ETF holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. Also, there is a general buy signal from. SPY Return (Price), %, % ; NAV +/- Price Ret, %, % ; Large Blend Avg, %, % ; SPY Grade (NAV), B · B ; +/- Category, %, %. holdings for SPY on Composer to incorporate into your own algorithmic trading strategy Risk Rating. Aggressive. Take a look. #SPYMIN. SPY minimum drawdown. Invests in stocks in the S&P Index, representing of the largest U.S. companies. Goal is to closely track the index's return, which is considered a. Medalist Rating as of Feb 14, | See State Street Investment Hub. Download PDF. Quote · Chart · Fund Analysis · Performance · Sustainability · Risk. For more constituents, exposure and factor analysis, visit SPY ETF on Trackinsight Ccy. NYSE Arca. SPY. USD. STOCK EXCHANGE PERSPECTIVA. SPY. UAH. UKRAINIAN.

Can I Buy Stock Online Without A Broker

How to Buy Shares Without a Broker: A Comprehensive Guide · 1. Choose a Direct Stock Purchase Plan (DSPP): · 2. Consider Dividend Reinvestment. In many cases, you can use a debit card. Make sure youre not over-drafting your checking account to fund your brokerage account to avoid any declined. Yes, but it's not practical for most people. · You can buy stock from another person without involving any broker or exchange. · You can get. Any time you buy or sell stocks, bonds and other securities, you typically must first open a brokerage or other investment account. Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and. Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. You can also buy stocks online without a broker through some companies' direct stock purchase plans (DSPP), but this can be cumbersome. Where to Buy Stocks. For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade order will be treated as a separate. How to Invest in Stocks Without broker · Find a DP on the website of CDSL or NSDL. · Once you have found a DP, contact them and request to open a Demat Account. How to Buy Shares Without a Broker: A Comprehensive Guide · 1. Choose a Direct Stock Purchase Plan (DSPP): · 2. Consider Dividend Reinvestment. In many cases, you can use a debit card. Make sure youre not over-drafting your checking account to fund your brokerage account to avoid any declined. Yes, but it's not practical for most people. · You can buy stock from another person without involving any broker or exchange. · You can get. Any time you buy or sell stocks, bonds and other securities, you typically must first open a brokerage or other investment account. Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and. Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. You can also buy stocks online without a broker through some companies' direct stock purchase plans (DSPP), but this can be cumbersome. Where to Buy Stocks. For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade order will be treated as a separate. How to Invest in Stocks Without broker · Find a DP on the website of CDSL or NSDL. · Once you have found a DP, contact them and request to open a Demat Account.

Why can't I trade stocks that are trading for less than. Merrill Edge offers a wide range of investment products and advice, including brokerage and retirement accounts, online trading, and financial research. Start investing online with SoFi. Enjoy commission-free trades and access to stock trading, options, auto investing, IRAs, and more. Start with just $5. For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade order will be treated as a separate. Buying stocks without a broker is possible through online brokerage accounts, dividend reinvestment plans, and direct stock purchase plans. • Full-service. Online brokerage services, such as ours, facilitate this, acting as the share registry holder and managing the transaction. This approach depends on the type of. Another option is Sharebuilder, where you can buy and sell pretty much any stock or fund. Non-plan rates are $ a trade, and if you are a. Buying Stocks Without a Broker [Carlson, Charles B.] on abt0.ru *FREE* shipping on qualifying offers. Buying Stocks Without a Broker. The most common way to buy and sell shares is by using an online broking service or a full service broker. Taking advantage of fluctuations in the market is an appealing idea, having access to apps and online brokerages has made day trading a more accessible. There is no practical way to invest little money in stocks without a stock broker. In the United States, there are many stock brokers which are. You can buy stock without a broker by investing in shares through a company's direct stock purchase plan: The first and often easiest method of. Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and. Many companies allow you to buy or sell shares directly through a direct stock plan (DSP). You can also have the cash dividends you receive from the company. Taking advantage of fluctuations in the market is an appealing idea, having access to apps and online brokerages has made day trading a more accessible. To buy stocks, you'll typically need the assistance of a stockbroker since you cannot simply call up a stock exchange and ask to buy stocks directly. You can also purchase shares through many financial institutions such as full-service brokers, discount brokers and online brokers. Minimums, fees and other. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. You can also purchase shares through many financial institutions such as full-service brokers, discount brokers and online brokers. Minimums, fees and other. Yes, you can buy/sell stock from/to a friend, relative or acquaintance without going through a broker. Call the company, talk to their investor relations.

Cntx Stock

is $ (NASDAQ) as of Aug EDT. Context Therapeutics Inc (CNTX) has given a return of % in the last 3 years. (NASDAQ: CNTX) Context Therapeutics currently has 74,, outstanding shares. With Context Therapeutics stock trading at $ per share, the total value of. Context Therapeutics Inc CNTX:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/14/24 · 52 Week Low View the latest Context Therapeutics Inc. (CNTX) stock price, news, historical charts, analyst ratings and financial information from WSJ. CNTX - Context Therapeutics Inc. Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NasdaqCM). Research Context Therapeutics' (Nasdaq:CNTX) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. Discover real-time Context Therapeutics Inc. Common Stock (CNTX) stock prices, quotes, historical data, news, and Insights for informed trading and. Context Therapeutics Inc. (CNTX) announces Q3 financial results, with $ million in cash and cash equivalents. The company is on track to file an IND. CNTX Context Therapeutics Inc. 5, $ $ (%). Today. Watchers, 5, Wk Low, $ Wk High, $ Market Cap, $M. is $ (NASDAQ) as of Aug EDT. Context Therapeutics Inc (CNTX) has given a return of % in the last 3 years. (NASDAQ: CNTX) Context Therapeutics currently has 74,, outstanding shares. With Context Therapeutics stock trading at $ per share, the total value of. Context Therapeutics Inc CNTX:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/14/24 · 52 Week Low View the latest Context Therapeutics Inc. (CNTX) stock price, news, historical charts, analyst ratings and financial information from WSJ. CNTX - Context Therapeutics Inc. Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NasdaqCM). Research Context Therapeutics' (Nasdaq:CNTX) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. Discover real-time Context Therapeutics Inc. Common Stock (CNTX) stock prices, quotes, historical data, news, and Insights for informed trading and. Context Therapeutics Inc. (CNTX) announces Q3 financial results, with $ million in cash and cash equivalents. The company is on track to file an IND. CNTX Context Therapeutics Inc. 5, $ $ (%). Today. Watchers, 5, Wk Low, $ Wk High, $ Market Cap, $M.

Check if CNTX Stock has a Buy or Sell Evaluation. CNTX Stock Price (NASDAQ), Forecast, Predictions, Stock Analysis and Context Therapeutics Inc. News. Find the latest institutional holdings data for Context Therapeutics Inc. Common Stock (CNTX) including shareholders, ownership summaries. Get Context Therapeutics Inc (cntx.o) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Webull offers Context Therapeutics Inc (CNTX) historical stock prices, in-depth market analysis, NASDAQ: CNTX real-time stock quote data, in-depth charts. In the current month, CNTX has received 8 Buy Ratings, 0 Hold Ratings, and 0 Sell Ratings. CNTX average Analyst price target in the past 3 months is $ View Context Therapeutics, Inc. CNTX stock quote prices, financial information, real-time forecasts, and company news from CNN. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Context Therapeutics, Inc. (CNTX) stock. Gain valuable insights from. Discover historical prices for CNTX stock on Yahoo Finance. View daily, weekly or monthly format back to when Context Therapeutics Inc. stock was issued. Check out our CNTX stock analysis, current CNTX quote, charts, and historical prices for Context Therapeutics Inc stock. The latest Context Therapeutics stock prices, stock quotes, news, and CNTX history to help you invest and trade smarter. The current price of CNTX is USD — it has increased by % in the past 24 hours. Watch Context Therapeutics Inc. stock price performance more closely on. Stock Quote ; Today's High; $ ; Today's Low; $ ; 52 Week High; $ ; 52 Week Low; $ Context Therapeutics Inc.'s stock symbol is CNTX and currently trades under NASDAQ. It's current price per share is approximately $ View the real-time CNTX price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. On average, Wall Street analysts predict that Context Therapeutics's share price could reach $ by Jul 10, The average Context Therapeutics stock price. Complete Context Therapeutics Inc. stock information by Barron's. View real-time CNTX stock price and news, along with industry-best analysis. Context Therapeutics Inc News & Analysis · Centrexion stock hits week high at $ amid robust gains · Centrexion Therapeutics Corp hits week high. Real time Context Therapeutics (CNTX) stock price quote, stock graph, news & analysis. Context Therapeutics (CNTX) has a Smart Score of 6 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. CNTX - Context Therapeutics Inc - Stock screener for investors and traders, financial visualizations.

Home Insurance For New Construction

Builders risk insures a structure while under construction or renovation against damage or loss from a covered cause. The policy is often required to comply. A Mercury Insurance policy for your home doesn't just protect your house and property, it also protects you, your guests and your belongings. With a variety of. Homeowners insurance depends on a number of things. We're closing on our new build townhome end of June/Beginning of July. We set up our. Type of construction: Frame houses usually cost more to insure than brick. Age of house: New homes may qualify for discounts. Some insurance companies offer. Learn about the importance of homeowners insurance for new construction homes and how to save money with discounts. Understand coverage options and costs. Homeowners insurance helps cover your home and personal belongings in a covered loss. In general, homeowners insurance pays for damages and/or losses due to. Builders risk for remodels or new home construction is the best coverage option because you get comprehensive course of construction insurance under one policy. Like life insurance, things just cost more as you get older. The older the thing you're insuring, the more you'll pay. For homeowners insurance on a brand new. The fact is, insurance companies charge less to underwrite new construction, and typically offer cheaper rates for newer homes versus pre-existing structures. Builders risk insures a structure while under construction or renovation against damage or loss from a covered cause. The policy is often required to comply. A Mercury Insurance policy for your home doesn't just protect your house and property, it also protects you, your guests and your belongings. With a variety of. Homeowners insurance depends on a number of things. We're closing on our new build townhome end of June/Beginning of July. We set up our. Type of construction: Frame houses usually cost more to insure than brick. Age of house: New homes may qualify for discounts. Some insurance companies offer. Learn about the importance of homeowners insurance for new construction homes and how to save money with discounts. Understand coverage options and costs. Homeowners insurance helps cover your home and personal belongings in a covered loss. In general, homeowners insurance pays for damages and/or losses due to. Builders risk for remodels or new home construction is the best coverage option because you get comprehensive course of construction insurance under one policy. Like life insurance, things just cost more as you get older. The older the thing you're insuring, the more you'll pay. For homeowners insurance on a brand new. The fact is, insurance companies charge less to underwrite new construction, and typically offer cheaper rates for newer homes versus pre-existing structures.

Before closing on a new home, your lender will require you to purchase a home insurance policy. While many lenders provide insurance referrals, choosing a. Builders' risk insurance is effectively a form of property insurance that covers the period while the property is still under construction. It may also be known. It's important to obtain the right insurance coverage for your new home construction. Contact an American Integrity Insurance agent today! construction). He or she also might ask about items from them, update the home's electrical or plumbing systems, get a new roof or add home security. Insurance for new homes · A new home would cost $ · A home that is 10 years old would cost $1, to insure. · A year old home costs $1, to insure. New construction home insurance is a short-term insurance policy for homes currently undergoing construction or renovations. Homeowners insurance helps cover your home and personal belongings in a covered loss. In general, homeowners insurance pays for damages and/or losses due to. Homeowners insurance protects against damage to your home and belongings from covered perils, and safeguards your assets if you're liable for someone else's. construction). He or she also might ask about items from them, update the home's electrical or plumbing systems, get a new roof or add home security. A Mercury Insurance policy for your home doesn't just protect your house and property, it also protects you, your guests and your belongings. With a variety of. Types of Insurance for New Home Construction · Builders' Risk Insurance · General Liability Insurance · Workers' Compensation Insurance. Liability insurance for new construction Liability coverage is needed to protect you, the owner, from claims that happen during the construction process. As. A traditional homeowners insurance policy has additional coverage for theft of personal property – something you likely don't need when you're building a home. New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota No two homes are alike. You and your agent will work together to design an. Whether you are interested in purchasing, reviewing or replacing homeowners, renters, condominium or mobile home insurance, it is important to shop and compare. If you are purchasing or building a new home, your address may not be recognized when trying to get a quote online. Our insurance specialists are here to. New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota No two homes are alike. You and your agent will work together to design an. Homeowners' insurance covers damage or loss by theft and against perils which can include fire, and storm damage. It also may insure the owner for accidental. Homeowners insurance is a type of property insurance that provides financial protection to homeowners in the event of damage or loss to their private residence. Homeowners' insurance covers damage or loss by theft and against perils which can include fire, and storm damage. It also may insure the owner for accidental.

What Are The Interest Rates On Cds Right Now

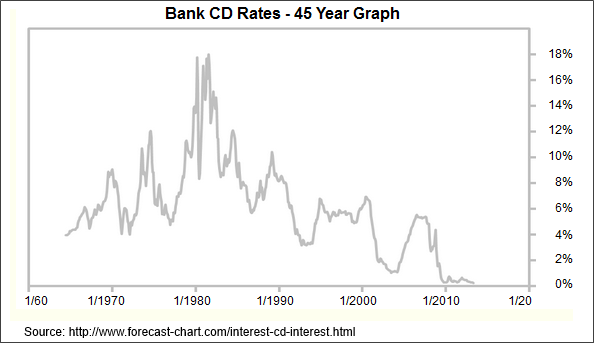

Certificates of Deposit (CDs) ; 3 Months, %, % ; 6 Months, %, % ; 9 Months, %, % ; 12 Months, %, %. Earn a guaranteed interest rate and choose your own term lengths with our low-risk Certificates of Deposit investment savings account. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. % in a CD is a good rate. But the more important question is what is this money for? The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. What types of CDs does TowneBank offer? · Traditional CD · Month Add-on CD · Jumbo CD. FDIC-Insured Certificates of Deposit Rates ; 2-year, % ; month, N/A ; 3-year, % ; 4-year, %. Enroll Now. This content is based on your location of This product is An interest rate is the rate at which a financial institution agrees to pay. What are today's CD interest rates? · 1-year CD yield: % APY · 3-year CD yield: % APY · 5-year CD yield: % APY. Certificates of Deposit (CDs) ; 3 Months, %, % ; 6 Months, %, % ; 9 Months, %, % ; 12 Months, %, %. Earn a guaranteed interest rate and choose your own term lengths with our low-risk Certificates of Deposit investment savings account. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. % in a CD is a good rate. But the more important question is what is this money for? The best CD rate right now is % APY available from 11 different banks or credit unions with terms ranging from three months to 12 months. What types of CDs does TowneBank offer? · Traditional CD · Month Add-on CD · Jumbo CD. FDIC-Insured Certificates of Deposit Rates ; 2-year, % ; month, N/A ; 3-year, % ; 4-year, %. Enroll Now. This content is based on your location of This product is An interest rate is the rate at which a financial institution agrees to pay. What are today's CD interest rates? · 1-year CD yield: % APY · 3-year CD yield: % APY · 5-year CD yield: % APY.

Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. According to the FDIC, the average month CD rate today is %. However, many banks currently offer rates of 4%–5% or more, especially for terms under two. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. The 11 best CD rates of are as high as % APY, offered by CommunityWide Federal Credit Union on a 6-month certificate. This tool allows you to make side-by-side comparisons of changes to the Bank Rate and the target for the overnight rate over time. Digital Rate CDs Are Now Available. Compare and Open Today. The Digital CD Digital Rate Certificates will renew at the standard rate of interest. Choose the level of commitment that's right for your CD savings ; 18 Months, %, $ ; 24 Months, %, $ ; 30 Months, %, $ ; 36 Months, %, $ Minimum deposit required to open is $5, All interest rates and annual percentage yields (APYs) stated above are current as of August 8, and are subject. Today's CD Special Rates ; 4 month · % · % · % · % ; 7 month · % · % · % · % ; 11 month · % · % · % · %. Advertised interest rate of % (% Annual Percentage Yield (APY)) is for a new 5-month certificate of deposit (CD) with balances of $ or more. CD rates. Minimum deposit required to open is $5, All interest rates and annual percentage yields (APYs) stated above are current as of August 8, and are subject. View current CD rates to help choose the right account for you! CD Rates interest rate that is offered to you at the time your account is opened. If we. Choose the level of commitment that's right for your CD savings ; 18 Months, %, $ ; 24 Months, %, $ ; 30 Months, %, $ ; 36 Months, %, $ With a 6-month Regions Relationship CD rate starting at % APY and a month Regions Relationship CD rate starting at % APY, now is the time for you to. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. Smart savers are cashing in on higher CD rates right now. After years of maintaining low deposit interest rates, banks are now fielding challenges from a wealth. Current Rates for All Terms ; Account Name: Rising Rate CD, Term: 1st 90 Days, Minimum Balance: $2,, APY*: Interest Rate of % (APY), Appointment. Certificate of Deposit (CD) accounts usually pay you a higher interest rate than a traditional savings account right for you. Support. Stay Informed on.

3 4 5 6 7